Summary of the April 16 th 2024

Bloom Show Presentation

Thomas L. Prince, Ph.D.

Prince & Prince, Inc.

Columbus, OH USA

FloralMarketResearch.com

Special Note: This report summarizes the April 16th 2024 Prince & Prince (P&P) presentation on “The Bloom Show” hosted by Sahid Nahim and sponsored by Above All Flowers and New Bloom Solutions. That YouTube presentation detailed historical U.S. consumer floral purchasing trends for Mother’s Day, and revealed the initial model testing of the P&P “Obligation Floral Purchasing Theory.” The presentation can be viewed at the following link: https://www.youtube.com/watch?v=s7ucbUC1Woc

Objectives

The April 16th YouTube “Bloom Show” presentation on consumer floral purchasing for Mother’s Day laid out five major objectives:

1) Gain an understanding of historical consumer floral purchasing trends for the Mother’s Day holiday,

2) Know how Mother’s Day floral purchasing trends vary by key consumer demographics and product usage (e.g. consumer age, educational attainment, and floral spending levels),

3) Know the importance of Mother’s Day in helping to build the floral market overall by examining the associations (correlations) of consumers’ Mother’s Day floral purchasing with floral purchasing for other occasions and events,

4) With P&P’s historical household floral purchasing trend data and U.S. Census data, make a floral market projection for Mother’s Day 2024 (retail dollar valuation), and

5) Overall, discuss the implications of consumer floral-market trends on marketing and business strategies for a most successful Mother’s Day.

This report summarizes the P&P consumer market information on floral purchasing for Mother’s Day. The YouTube presentation adds the initial model testing of the Prince & Prince “Obligation Floral Purchasing Theory”, and it can be viewed at the following link: https://www.youtube.com/watch?v=s7ucbUC1Woc

Research Framework

Consumer floral purchasing data for Mother’s Day was obtained from four Prince & Prince (P&P) nationwide surveys of floral-buying households (The P&P U.S. Consumer Floral Tracking Survey) for the years 2000, 2007, 2013, & 2019 (Prince & Prince, 2020).

Each survey comprised a random selection of over 1,000 floral-buying household respondents throughout the U.S., providing a +/- 3% sampling error for each study (over 5,000 respondents across all four studies). The four-page printed survey captured over 100 metrics on the floral-purchasing behaviors of U.S. consumer households: what they buy, where they buy, when they buy, why they buy, and how much they spend on fresh cut flowers and indoor potted plants. The survey also captured a 30-attribute customer service and satisfaction evaluation of the floral businesses where the households shopped, including florist shops, garden centers, supermarkets, super-discounters, home/ hardware centers, wholesale clubs, farmer’s markets, and floral Internet-based businesses.

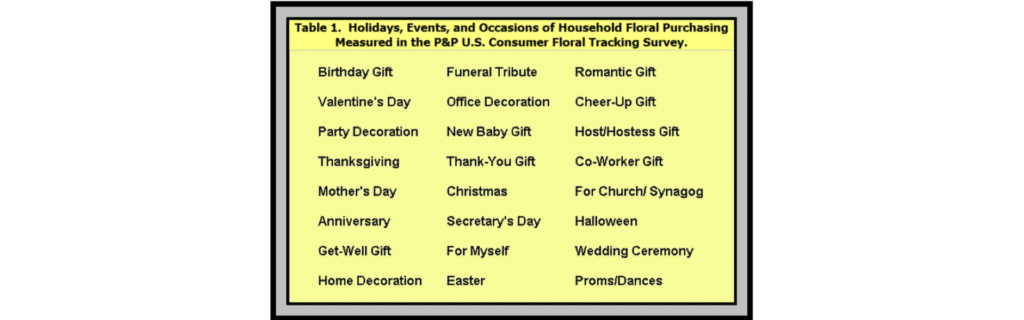

The survey methodology comprised mailed surveys for the year 2000, 2007, and 2013 studies, and a mixed-mode survey (mailed surveys plus Internet-based surveys) for the 2019 study. The mixed-mode survey is now a preferred survey method as it reduces respondent age bias in both mailed-only and Internet-only surveys (Dillman, 2014). P&P defines “floral” as fresh cut flowers (fresh arrangements, bouquets, single stems/ /bunches, and corsages), and indoor potted flowering plants, and indoor potted foliage plants & planters. For this reporting, the survey metric of interest is the “Household incidence of floral purchasing for Mother’s Day”, measured as “yes” (1), or “no” (0). This metric measured any type of floral purchase (the floral definition previously described to the survey respondent) by any member of the household for Mother’s Day. In the P&P reporting, the purchasing metric is computed as the percentage of floral-buying households that made at least one floral purchase for Mother’s Day for the year surveyed. The Mother’s Day purchasing metric is one of 24 metrics in the P&P survey that measures the holidays, events, and occasions of consumer household floral purchasing (Table 1).

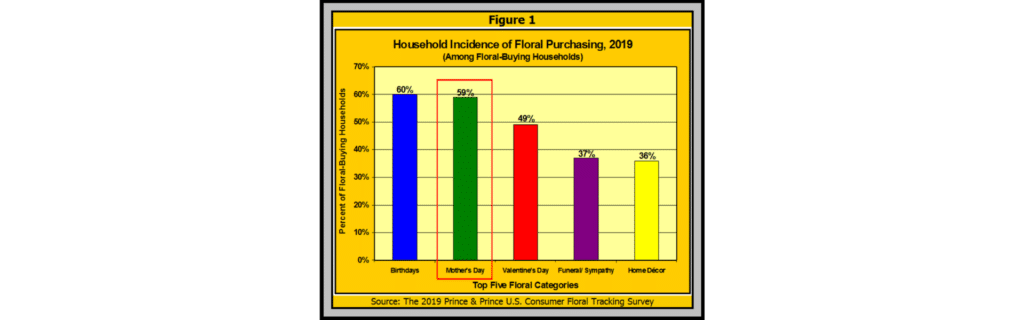

Nearly 60% of all floral-buying households throughout the U.S. (59%) purchased floral products for Mother’s Day in 2019 (Figure 1).

Of the top five floral categories of usage by consumer households in 2019, Mother’s Day was ranked second, behind floral purchasing for Birthdays (60%), which occur throughout the year. With 59% of floral-buying household purchasing floral product for Mother’s Day, it is the most important single day (or single week) holiday for the U.S. floral industry, and is ranked higher than Valentine’s Day (49%), Funeral/Sympathy (37%), and Home Décor floral purchasing (36%). The floral industry needs to embrace the importance of the biggest of all floral holidays, and not take Mother’s Day for granted, and understand that like Valentine’s Day, a consumer floral purchase for Mother’s Day may likely lead to more consumer floral purchasing throughout the year.

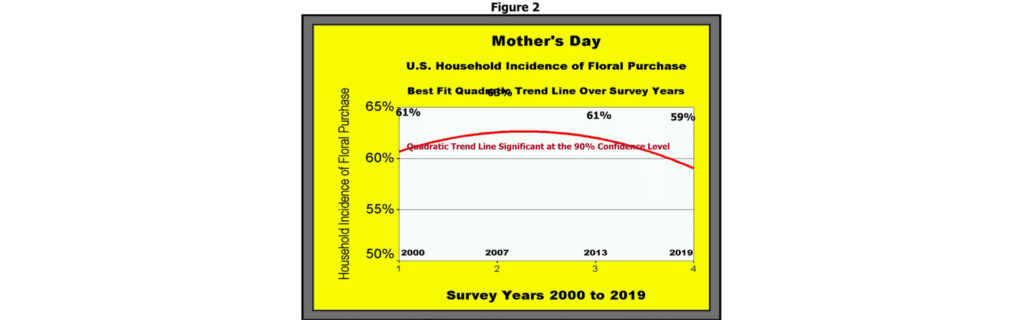

Trend in Household Incidence of Floral Purchasing for Mother’s Day

Since 2007, there has been a slight decline in the household incidence of floral purchase for Mother’s Day, going from about 60% in year 2000, up to 63% in 2007 (peak), down to 61% in 2013, and down further to 59% in 2019, a four percentage-point decline over 12 years (Figure 2). P&P conducted statistical trend analysis (MANOVA; SPSS, 1999) of the purchasing data over the study years and determined that a quadratic trend line best fit the data, suggesting that the slight decline in purchasing is projected to continue, and to become worse. This decline in household purchasing is not likely “felt” by the floral industry, as the number of households in the U.S. continues to expand at a higher rate (over 1% annually), compared to the decline in household purchasing (about one-third of one percent annually).

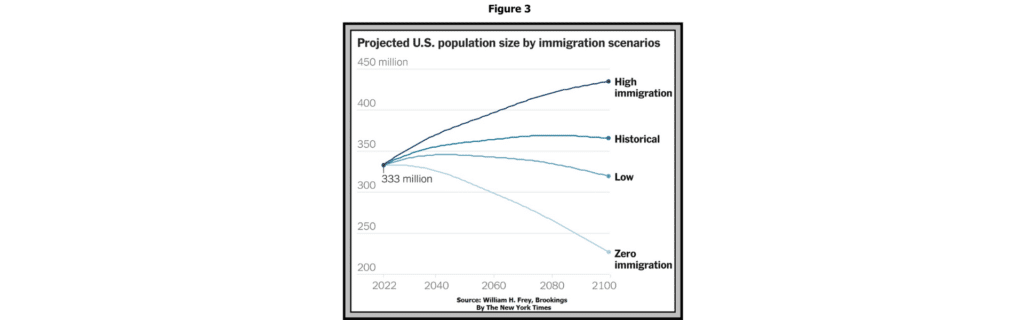

Since the incidence of floral purchases for Mother’s Day is relatively high and relatively stable, the growth in floral sales for Mother’s Day will likely continue in the near term, as long as the number of households in the U.S. continues to rise. The Brookings Institute has recently analyzed U.S. Census Bureau population trends and has made U.S. population projections for the next 80 years with four U.S. immigration policy scenarios: 1) U.S. historical immigration policy (net 850,000 to 980,000 people annually), 2) probable lower immigration policy (net 350,000 to 600,000 people annually), 3) probable higher immigration policy (net 1.5 million people annually), and 4) zero immigration policy (miniscule out-migration and no in-migration). (Frey, 2023). These population projections are shown in Figure 3.

Assuming a “Historical immigration policy” going forward, the U.S. population peaks at about 360 million around 2080, but with a “Low immigration policy” going forward, the population peaks at about 340 million around 2040. With a “High immigration policy” going forward, the U.S. population continues to grow into the future, even past 2080, with a population of about 430 million in 2080. A “Zero immigration policy” going forward, a highly unlikely event, reveals a current stable population of about 333 million up through 2030 and then a continuing decline in population thereafter as the number of deaths in the U.S. surpasses the number of new births. Thus, in the near term (next ten years), the U.S. population is expected to rise in all immigration scenarios (except the “Zero immigration policy” scenario), which likely supports an ever-increasing Mother’s Day floral holiday.

Floral Purchasing for Mother’s Day By Consumer Age

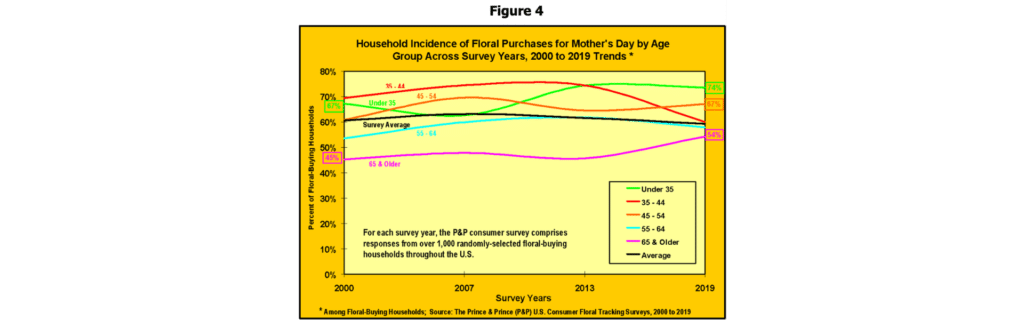

The historical household purchasing trends for Mother’s Day by consumer age groups are shown in Figure 4.

Mother’s Day that were once large in year 2000 are still quite substantial in 2019. The Under 35 age group has consistently shown a strong purchase incidence for Mother’s Day over the study years, and this age group attained the overall highest level of floral purchase incidence for Mother’s Day in 2019 (74%). Since 2013, the 65 & Older age group has made strong gains in purchase incidence for Mother’s Day (45% in 2013, to 54% in 2019), compared to other age groups. Both age groups (largely Millennials and Baby Boomers) are not only large in size in the US population (about 72 million in US population for each group in 2019), but have also recently witnessed strong gains in household growth (McCue, 2023). Like the P&P consumer findings for Valentine’s Day, the purchasing strength for Mother’s Day also is being fueled by both the youngest and the oldest age groups. An effective marketing strategy for Mother’s Day should likely target either or both consumer groups with specific communication appeals and age-appropriate floral offerings. As with Valentine’s Day, this dual market dynamic for Mother’s Day (the two largest and growing consumer segments influencing Mother’s Day floral purchasing are at the opposite ends of the age spectrum) may pose an additional challenge for floral retailers in achieving a most successful Mother’s Day.

Floral Purchasing for Mother’s Day By Educational Attainment

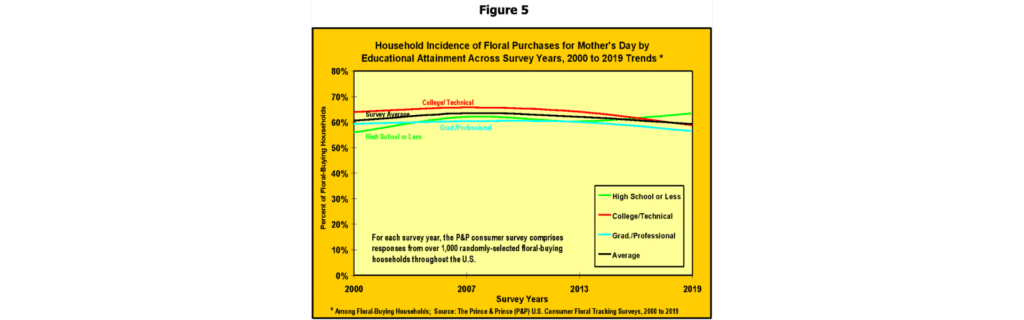

Historically, the level of educational attainment of the household has had only a small impact on the incidence of floral purchases for Mother’s Day (Figure 5). Since 2007, college educated and graduate/professional degreed households have shown a slight decline in floral purchasing for Mother’s Day. Over the past 20 years (since 2000), only those households with a High School education or less have shown a gain in floral purchasing for Mother’s Day. Does this educational attainment trend, however slight, help explain the overall quadratic declining trend line in Mother’s Day floral purchasing in the U.S.? The educational attainment trend does suggest that floral purchasing for Mother’s Day is losing some favor among the more highly educated U.S. households. Which begs the question, are the current floral offerings for Mother’s Day somewhat lacking in sophistication for the more highly-educated floral buyer? P&P intends to track these trends in Mother’s Day floral purchasing with the proposed 2024 P&P survey, to determine if the declining purchasing trends among the higher-educated consumer segments continue, or if they are abated.

Floral Purchasing for Mother’s Day By Floral Spending Levels

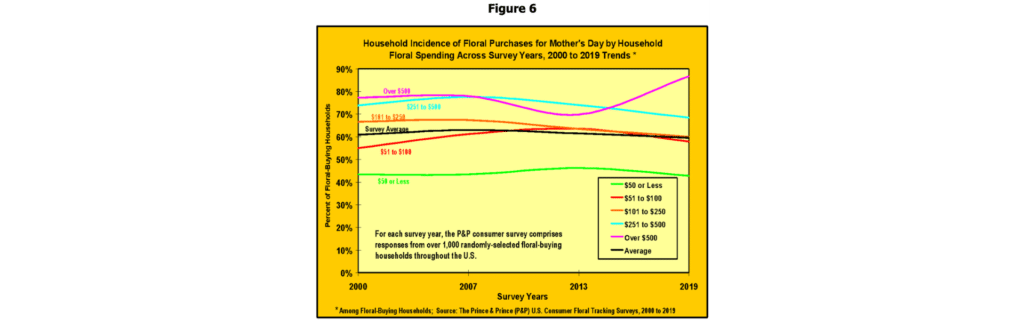

The historical household purchasing trends for Mother’s Day by level of annual household floral spending are shown in Figure 6. Over the past twenty years, the “biggest” floral-spending households (based on annual floral spending) have generally shown the highest incidence of floral purchases for Mother’s Day, and for 2019, it was the highest (over 85%). This purchasing trend by consumer spending-level groups clearly reveals that the biggest floral spenders are definitely “in the market” for Mother’s Day! Since 2013, the biggest floral-spending households (spending over $500 annually) have been the only floral-spending group to increase their incidence of floral purchases for Mother’s Day. Note that the more “minimal” floral-spending households have recently witnessed a slight decline in purchase incidence for Mother’s Day, in striking contrast to their Valentine’s Day floral purchasing trends.

The consumer purchasing trends by level of household floral spending does not suggest that the Mother’s Day holiday is bringing new buyers into the floral market, as the percentage of buyers purchasing in these lower-dollar purchasing groups declines over time (the opposite trend was shown for Valentine’s Day floral purchasing). Overall, the household floral-spending trends for Mother’s Day suggests that targeting the “big spenders” with attractive and “grand” floral offerings will likely be a successful strategy for Mother’s Day.

Correlations of Household Mother’s Day Floral Purchasing with Floral Purchasing for Other Occasions

Correlations represent statistics that measure the level of association among two things, shown as a decimal number between –1 (negative association), 0 (no association), and +1 (positive association). Correlations for floral purchasing categories show how the purchase of one floral category is associated with (or influences) the purchase of another floral category (positively or negatively). A high positive correlation among two floral categories shows that as one floral category is purchased, the likelihood of purchasing the other floral category is high. When correlations are computed among data scored as binary (e.g., 0, 1), the highest (lowest) correlation score obtainable is not 1 (-1), but about 0.67 (-0.67), due to the restriction of the data range. Since the P&P “Incidence of Purchase” data is scored 0 or 1, computed correlations for this type of data will likely be understated compared to the actual correlation.

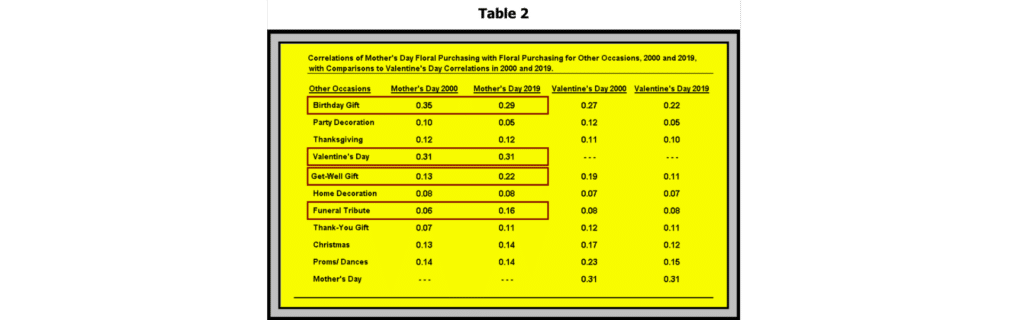

To examine how consumer household floral purchasing for Mother’s Day may affect other floral purchases of the household throughout the year, P&P computed correlation coefficients for the Mother’s Day purchasing data with purchasing data of ten selected floral occasions for two study periods, year 2000 and year 2019, using the SPSS Statistical Package (CORRELATION; SPSS, 1999). The correlations are shown in Table 2.

Mother’s Day floral purchasing shows the greatest association with floral purchasing for Birthdays, Valentine’s Day, Get Well Gifting, and Funeral Tributes (red boxed correlations in Table 2). Of the ten occasions selected for comparison, all ten show a positive purchasing correlation with Mother’s Day in 2019 and also in the year 2000. These correlations suggest that a Mother’s Day floral purchase may be garnering additional floral purchases for other holidays, events, and occasions. Note that for 2019, the Mother’s Day purchasing association with Get Well Gifting and Funeral Tribute has increased substantially since 2000 (this dynamic does not apply to Valentine’s Day).

The P&P consumer floral data reveals that Mother’s Day is not only a key sales day for the floral industry, but also a key market builder for the industry for other key floral purchasing events and occasions. While Mother’s Day floral purchasing may not be bringing new floral buyers into the market (as was the case for Valentine’s Day), it may be influencing “Obligate Floral Purchasing” and “Gifting” with existing floral buyers.

P&P’s Floral Market Projection for Mother’s Day 2024

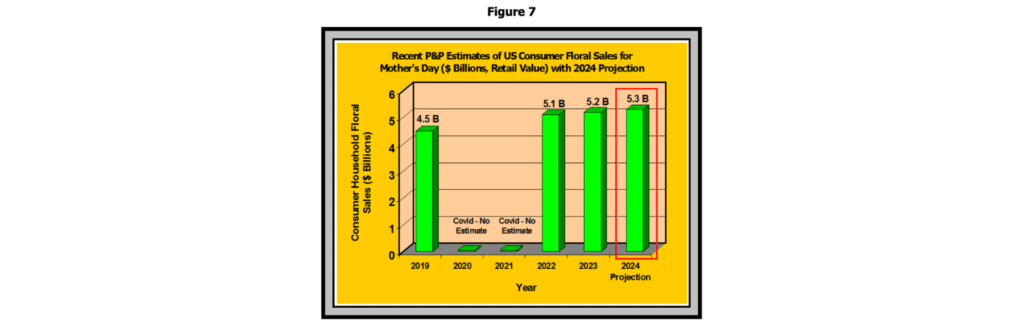

P&P has been making Mother’s Day floral market projections for the U.S. market over the past several years. Our floral market projections require four key pieces of information: 1) the number of U.S. households in a given year (provided by the U.S. Census Bureau and refined by the Joint Center for Housing Studies (JCHS) at Harvard University), 2) the floral “Participation Rate”, the percentage of U.S. households that make at least one floral purchase in a given year, calculated by P&P through survey “bridging and calibration” across several P&P floral-market studies, 3) the “Incidence of Purchase” for a particular floral occasion, estimates provided by P&P survey data (Prince & Prince, 2020), and 4) the average floral dollar spending per household for a particular occasion, estimates also provided by P&P survey data. The annual P&P Mother’s Day floral-market projections for the years 2019, 2022, and 2023, and the newest projection for 2024, are shown in Figure 7. In both 2020 and 2021, no market projections were computed due to the Covid-19 pandemic.

The P&P U.S. Mother’s Day floral market estimates (at retail) in 2019, prior to Covid-19, were $4.5 billion. After Covid-19, the 2022 U.S. floral market estimate for Mother’s Day came in at $5.1 billion, a relatively higher market estimate, helping to raise with inflationary pressures and an unexpected surge in younger households (Prince & Prince, 2023). The P&P U.S. Mother’s Day floral market estimate for 2023 was slightly higher at $5.2 billion. For 2024, the P&P U.S. Mother’s Day floral market estimate is projected to be $5.3 billion dollars (at retail value), another slight gain from 2023, even though the household incidence of floral purchase for Mother’s Day was projected to be slightly lower, at 55%, with inflation and increases in U.S. households also taken into account. This value of $5.3 billion includes all the value-added amenities to the floral product and any delivery/ service fees associated with the consumer’s floral purchase. These recent estimates signify continued growth in the U.S. Mother’s Day consumer floral market, albeit slower growth since periods prior to Covid-19.

About the P&P U.S. Consumer Floral Tracking Survey

P&P plans to commence a 2024 tracking survey of U.S. floral-buying households later this Summer/Fall (Prince & Prince, 2020). Please contact P&P if your company has an interest in becoming a P&P Research Sponsor. Research Sponsors receive the complete floral tracking survey results (current and historical floral-purchasing trends) through a one-day, on-site seminar with Q&A presented to a company’s management team, and the complete 800+ slide presentation on a flash drive. Sponsors also receive exclusivity of the floral market information for a one-year period following the completion of consumer research (the one-year data embargo period). The sponsor’s investment in the research is dependent on the number of sponsors participating. The overall project budget is divided equally among the sponsors. For more information, including the complete content of the consumer floral survey, please email Tom Prince at [email protected].

About P&P

Dr. Thomas Prince and his brother, Dr. Timothy Prince (both formerly of The Ohio State University, Department of Horticulture), co-founded Prince & Prince, Inc. (P&P) in 1990. The company is a leading marketing research specialist in the floral and green plant industries. Over the past 30+ years, P&P has completed more than 75 major marketing research projects and countless reports for the floral industry in the U.S. and has also conducted floral market projects in Canada and Europe. P&P has research experience in both experimental research design and survey research design, and often combines both research domains in the conduct of P&P research for their clients. P&P conceptualizes, designs, and implements market research projects and floral-product value analyses for floral companies and associations up and down the entire floral distribution channel. For more information, visit the web site at www.FloralMarketResearch.com or e-mail Tom at [email protected]

Literature Cited

Dillman, D.A., Smyth, J.D. and Christian, L.M. (2014). Internet, Phone, Mail, and Mixed-Mode Surveys (Fourth Edition). Hoboken, NJ: John Wiley & Sons, Inc.

Frey, W.H. 2023, New Census Projections Show Immigration Is Essential to the Growth and Vitality of a More Diverse US Population. The Brookings Institute. Washington, D.C.

McCue, D. (2023). The Surge in Household Growth and What It Suggests About the Future of Housing Demand. Joint Center for Housing Studies, Harvard University.

Prince, T.L. (2023). Where is the U.S. Floral Market Now Headed? . . . A Look Back, and a Look Ahead. (P&P Market Report). Columbus, OH: Prince & Prince, Inc. Also on LinkedIn: https://www.linkedin.com/pulse/where-us-floral-market-now-headed-look-back-ahead-thomas-prince/?trackingId=W%2B6j0gJCTJWbWkvXXeeYUg%3D%3D

Prince, T.L. and Prince, T.A. (2020). The 2019 Prince & Prince U.S. Consumer Floral Tracking Survey (On-Site Seminar with Q&A). Columbus, OH: Prince & Prince, Inc.

SPSS (Released 1999). SPSS (Statistical Package for the Social Sciences) for Windows, Version 10.05. (Base, Advanced Models, Categories, and Conjoint) Chicago, SPSS Inc.